The Future Of Fashion Forecast And Cash Flow

For instance, in 2018 the world produced 150 billion garments, and more than 50% of them are not wanted by consumers (another reference here). This is in spite of all the current methods of fashion forecasting. Hence, there is a huge impact of blocked capital in the industry and also a huge load of sustainability. We need a new way to forecast fashion and predict demand. It is time to Dare to Zig when everyone else Zags.

In this edit, we cover how fashion and brands, and retailers perform in one of the most important metrics for business “free cash flow”. In addition, we also cover what it takes to transform cash flow. This quote from Michael Dell is very relevant in these challenging times.

“We were always focused on our profit and loss statement. But cash flow was not a regularly discussed topic. It was as if we were driving along, watching only the speedometer, when in fact we were running out of gas.”

—Michael Dell, founder, and CEO, Dell Technologies

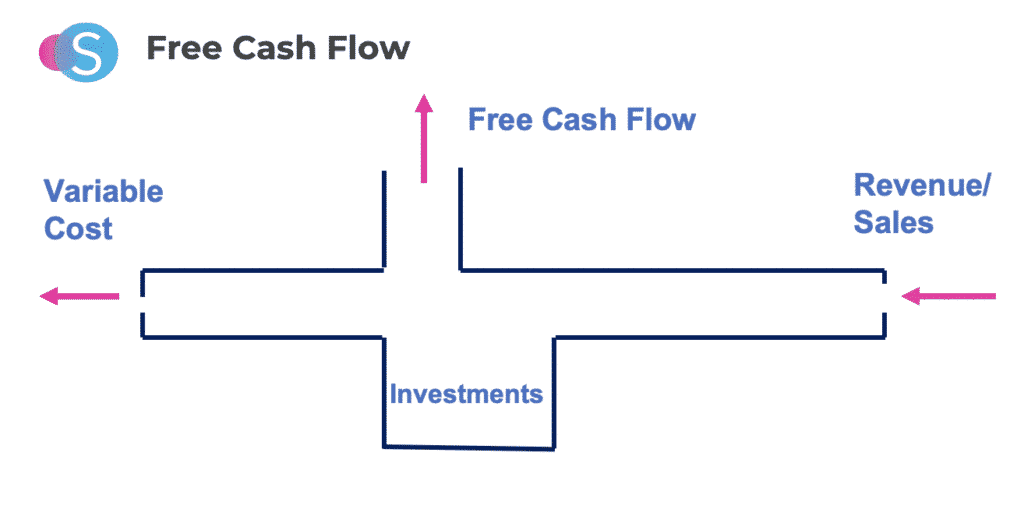

What is Free Cashflow?

A company can have good profit and may still struggle to have cash in the business. The earnings a company makes are further used for capital expenditures and what is left after the money available for any discretionary spend. This is a very important financial metric for any company.

Free cash flow is the engine that powers a company to invest in the future or share it with shareholders. It is computed as follows,

Free cash flow = Cash from operations (from Cash flow statement) – Investment in working capital (from cash flow statement)- investment in capital expenditure (from the balance sheet)

The cash flow of Fashion Brands/Retailers

Let us look at the free cash flow of some of the large fashion brands and retailers.

ZARA (2018): USD 2.84B, 10% of Net sales, growing at 10% over last year

H&M (2018): USD 1.17B, 5.6% of Net Sales, growing at 5.6% over last year

Macy’s (FY 2019): USD 0.7 B, 2.8% of Net sales, de-growing at 30% over last year, previous years almost flat

Nordstrom (FY 2019): USD 0.9 B, 5.8% of net sales, growing at 41% over last year

GAP (FY2019): USD 0.35 B, 2.1% of net sales, de-growing over last year by 51%

note: all numbers are derived from the published financial statements

As you can see Zara has the highest free cash flow to sales ratio. In other words, for almost similar turnover Zara is approximately 200% more effective in bringing cash into the company than H&M and Nordstrom. It is approximately 400% more effective than Macy’s and GAP. We are not recommending the acceleration of fast fashion rather minimize guesswork and reduce the risk of ill-informed decision making. In fact, make the world sustainable by reducing wastage. Here is a tweet from the United Nations about Stylumia enabling sustainability.

There are many factors for business model success. It is clear from the above that the business that listens to the consumer in product decisions performs better than the ones that are push-driven. Zara is a clear example. This does not mean it is fast fashion alone.

The principle is that demand and consumer-driven fashion forecast is one of the key levers of an effective fashion business that keeps the cash flowing through the system. Share on XLet us now look at how fashion forecast impacts free cash flow.

How the forecast impacts cashflow?

Retail has two sides to it, on the demand side consumer and on the supply side products. Rest all in between are enablers. Products are an outcome of the fashion forecast. It is the velocity of revenue/sales that is influenced strongly by the relevance of products.

The traditional fashion forecast through existing platforms is to a large extent snapshot and, subjective in nature. Even the ones which are data-driven are giving supply signals. In the dynamic information-rich world, we are living in, we are holding on to an old horse and trying to make it run faster. It is time to look for an automobile.

Time for a paradigm shift in fashion forecasting.

This is the key reason for the fashion industry to be saddled with such a mind-blogging surplus and poor financials, in particular cash metrics. Solving this puzzle needs a look into two aspects of the fashion forecast.

Quality of Design

This is the relevance of products to consumers. This is addressed now by traditional forecasts as mentioned above. This needs a re-invention

Quantity forecast

The challenge is to predict the right quantity and get your demand prediction closer to reality.

There is no bad fashion design or product when you make the right quantity. In the world of lagom, we will have minimal wastage. Share on XHence, the way to improve free cash flow is to simultaneously work on both qualitative and quantitative fashion forecasts. The need to re-invent the fashion forecast.

Re-invent qualitative fashion forecasting

There is no dearth of information and in fact, we have an overflow. What fashion designers need now is a filter that is consumer-centric and demand-driven. Share on XWhat this means, is sifting through the world of information, remove the noise from the signal almost on a real-time basis. This does not mean a lack of innovation. It is just taking the right signals into the design process. The world of online advertising is a clear example of how it is multi-fold better than traditional delivery mechanisms and increased the efficiency of the world of advertising.

This made us thinking at Stylumia and, we came up with a unique proprietary demand-sensing engine to do consumer research on steroids. You can check more about our tool and reduce unwanted inventory.

Re-invent quantitative demand prediction

As mentioned earlier, quantity demand forecast or demand prediction is as important as the quality of designs. The challenge in fashion is the non-repetitive nature of designs and even the repetitive products have high demand variability.

There is no reliable way to predict the demand for unseen new products. This is a non-trivial problem. Even the machine learning models using fashion attributes to predict find it difficult as fashion can not be explained in attributes.

Let us take an example. Can we do justice by explaining color in the text form? No. Even if we say light blue, there are millions of blue, how will the model know what blue works and what does not. This is the simplest of attributes, how about complex prints? and their combinations.

This needs a new way to predict the demand for fashion products at the style/color level. The challenge is not just to predict demand pre-season but also to grade all the products to get your assortment width and depth right.

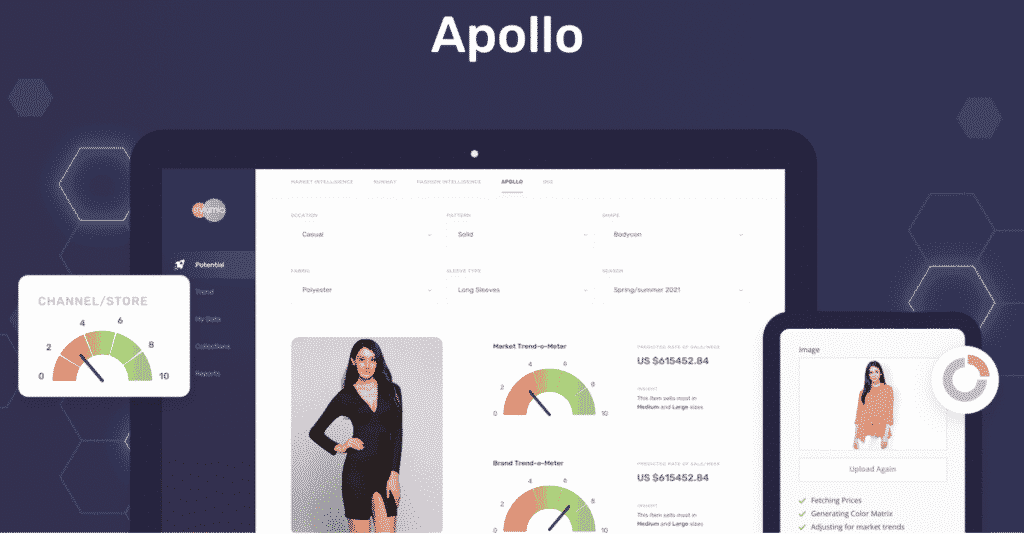

We at Stylumia created one of its kind prediction engine APOLLO to solve this challenge. We are able to create a significant lift in prediction accuracies and the model considers your supply chain lead times.

Once you get your quality of design relevant and the quantity demand prediction right, you have a high probability of revenue throughput. This is what our customers experience when they take design inputs and quantity inputs from the Stylumia platform. We have demonstrated revenue growth of up to 60% and full price sell-through improvements of 6-8% (absolute).

In conclusion,

In the conditions of flux under COVID-19, and in the times to come, it is more important than ever before to build responsive capabilities in your fashion business. Hence, being agile and nimble is very critical to business success. Also, cash is a most precious resource now than ever before. The cost of making a wrong decision is very high.

One of the ways to address this is to make informed product decisions through the fashion supply chain. A clear urgent need for digital transformation in the product development process.

Hope you found this post addressing the fundamentals of free cash flow and how the forecast impacts this key metric.

If you would like to know more about Stylumia solutions, please reach out to us.