Move From Common Practice To Common Sense: Grow Profits By 5X

In this edit, we will learn how to grow profits by 5x by moving from common practice to common sense. We are using Eliyahu’s approach to look at how a fashion business is conducted and come out with a theory for transformation.

Fasten your seatbelts.

Following are the list of questions asked by Eliyahu to a group of leaders of a Brand company (BRAND ABC) and their answers. It all started with how much a company can improve over time and why a quantum jump in performance is not possible for a large brand?

Q1. What is the profit (EBITDA) of a fashion brand?

A1: 10% is a good number.

Validating with some global brands and mono-brand retailers for 2017 (numbers are taken from their published financial reports, the links of which are provided)

Polo Ralph Lauren: 10.7%

Inditex : 20.9%

H&M : 10.3%

UNIQLO : 16.6%

Details of some of the listed Indian brands and retailers (ADITYA BIRLA FASHION & RETAIL, SSTOP, TRENT, KEWAL KIRAN, ZODIAC, INDIAN TERRAIN)

Clearly, Inditex stands out in the pack at scale.

Note: There may small difference in numbers due to varying terminologies of profit across companies, it does not impact the spirit of this edit.

Q2. By how much do you think you can increase your net profit in say 5 years?

A: Double it in 5 years (about a billion US$), that is an ambitious one.

We tried to validate this across various brands above, except for one brand the growth has been around 20-40% over 4-5 years. That validates the ambitious nature of doubling over 5 years.

Q3: Do you think you can reach a net profit of USD 4 billion?

A: It’s utterly unrealistic

Reflection

Most of the improvement initiatives are centered around cost savings/ transportation/cheaper acceptable suppliers etc.

Net profit can be improved by

a) Expansion or

b) Improving existing operations

Why not option (b)?

Q4: Can you examine the phenomenon of shortages (missing items)? On average, what % of items is missing from your shops?

A: While they knew shortages are prevalent, they did not have a clear idea of the magnitude. Speculation was it was probably around 30%

Q5: How much do you lose in sales because of the unavailability of products?

A: <30 %, because many times when a customer who can’t find an item will still buy an alternate product.

Reflection

Disagree. I do agree some customers do buy alternate, but there is another factor that caused me to believe that lost sales are much higher than % of SKU’s that are missing.

Q6: Is there a pattern amongst the items that are missing from the shops?

A: Yes, the demand for these items > Forecast

Q7: Can we assume the demand for the missing items in stock is greater than the average demand for most of the items available?

A: They had to agree with most of the items in stock in the stores are relatively slow movers.

Q8: Doesn’t mean that the effect of lost sales is greater than the percentage of missing items?

A: Many speculated that the lost sales may be as high as 50%

Q9: If we take your existing sales as the baseline, doesn’t it mean that the amount you lose due to shortages is close to what you are selling now?

A: That shook the team a bit considering the magnitude of the impact of missing items.

Reflecting on this, attention moved to the warehouse. The missing SKUs from the warehouse are erased from the list of items the store should hold. It is important to investigate the additional impact of these shortages.

Q10: What is the lifetime of your products?

A: 6 months. We have 2 seasons in a year and we order and buy in batches of 6 months.

Q11: If we go to your central warehouse 3 weeks into a season, will I find missing SKUs?

A: Yes definitely. Also, these are hot sellers where the demand > forecast.

Q12: How much sales are lost from these items not being available?

A: They were not clear. If an item was depleted in month 1, then lost sales will be 5 months, if it is depleted in 2 months, then lost sales will be 4 months and so on.

Q13: How many items get depleted after 3 weeks? After 3 months? After 6 months?

A: No exact numbers by time frame but an estimate of SKUs stocking out in 3 weeks is roughly one third.

Q14: Should we not combine the impact of missing items in the warehouse with the missing items in the store?

A: Yes

There is a realization in the room that they were dealing with a phenomenon that is more than the total realized sales now.

Q15: Can you convert this realization to a bottom-line impact? If the company eliminates shortages, how much should we expect Net profit to go up?

A: If by a miracle, shops will not face any shortages, the brand need not increase infrastructure, hence resulting increase in sales will have a proportional impact on the bottom line.

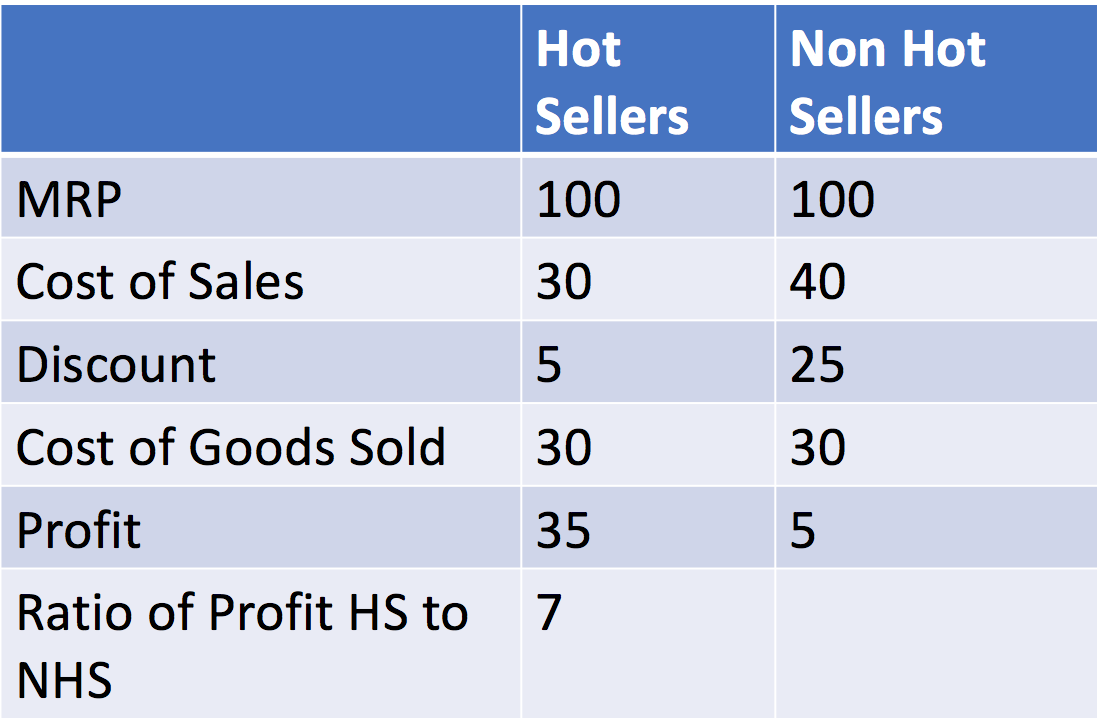

It will be good to pause here and see the profit generated from fast sellers vs the rest of the items. A representative structure of a brand with 3.3 costs to MRP multiplier would look like this.

With the hot sellers having a 7 multiple of the rest of the items, the team now was in a state of shock, that the 4 billion dollar profit possibility is a reality.

Q16: How come they had not realized that before?

The culture in the industry is dominated by the fact that for several generations they have been dealing with an environment in which the lifetime of the products in the market is shorter than the time to supply. This is an extremely difficult situation to deal with and no wonder, with time, the industry developed a protective mechanism; a culture of camouflaging the painful problems so that they can be embraced. For example, how does the industry relate to the phenomenon of the huge lost sale of items that are no longer available before the end of the season? They do not have a title with a name that clearly shows a negative impact, rather they camouflage it with a positive title: call it Sold Out. They all agreed that they consider sold out as something positive.

In the same way, the industry hides the other side of the same coin “Obsolescence”. It is hidden under the title “Outlet Sales” or “End of Season Sale“.

The amount of obsolescence in the system is as much as 30% and that is not a small phenomenon.

We must bear in mind that there are two phenomena co-existing. For a huge number of SKUs, there are considerable shortages, while at the same time, for another set of SKUs there are enormous surpluses.

Q17: How come?

They forecast a season ahead on how much to buy for each of the SKU’s. They ridiculed the fact that anybody can forecast demand 6 months in advance at the size level. No wonder for half the items they have shortages and for another half they have surpluses.

Q18: Can they do something about it?

Yes provided they drop the illusion that they can forecast, the illusion that the future demand is known.

They started to explore when they can get a reliable knowledge of which SKUs are moving well and which are not?

They claimed that they know this 2 weeks into the season but it is too late.

Q19: Is it? What will happen if the reaction time of the supply chain is faster?

Yes but it takes 60-90 days to produce.

Why it takes so much time when a garment can be made in a few minutes. It is because of the large batch size.

Q20: Why not order for the first 2-4 weeks first and get the supplier to feed the balance based on initial demand sense?

Yes. That would involve a fair bit of agility amongst our planning and the supplier end to be nimble.

The team agreed that this would definitely minimise the supply-demand gap. It is system-wide change but logical. This is doable and reduce the shortages to a fraction of what it is today and almost eliminate obsolescence.

For those who have channel partners, this approach is true provided we look at a fundamental guiding principle of “What is Sales?”

What this means is wholesale transactions are not to be considered as real sales (while the financial books will still show). Hence the brand needs to have clear information transparency with the retailer. One way to accomplish this is to inform the retailer that the brand can supply every 3 days what is sold out and replenish. Also, the retailer can send back what is not sold. This will ensure that the precious retail asset of the display is for all the selling items which in itself transform the throughput.

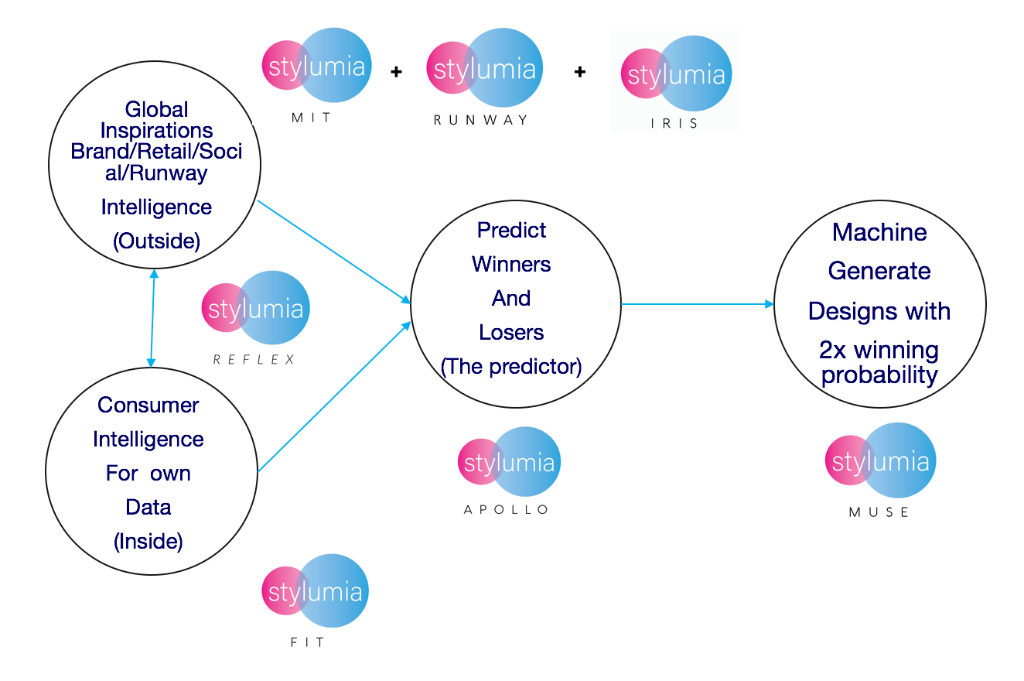

When Eliyahu wrote this case in 2006 (the original case here), we did not have the technology to analyse and predict fashion trends as it is today. In our view, Eliyahu’s abstractions of principles are timeless, irrespective of your speed of supply chain. Combining these principles with today’s technology in AI, Computer vision, any fashion brand can quantum jump in their performance. With global fashion intelligence, brands are equipped with consumer demand signals far better than the brand in the case study. Stylumia has now a suite of products (and constantly evolving) to take care of pre-season, in-season and post-season actions answering key questions What to spot/buy? How much to buy? Where to send it?

Are you continuing with the Common Industry Practice? Would you like quantum jump by shifting to Common Sense? Reach out to us for discussing your business case and next steps.